Published: 6/27/2024

Jason Bowen

VP, Sales, Dynata

If you could go back in time to the beginning of the internet, the dawn of the smart phone, when Facebook was still Facebook, or before the days when you did all of your shopping online…..knowing now how revolutionary those technologies and organizations have been, would you change anything?

Not only from an investment perspective, (Imagine if I invested $1,000 in Apple in 1996….) but from a place of curiosity and heightened focus. Any new technology that’s growing exponentially and benefits from Metcalfe’s law deserves early attention, if not complete attention.

Bitcoin is exactly that kind of a technology. Now 15 years old, would you be surprised to know:

- Bitcoin has been the best performing investment asset in 12 of those past 15 years, far surpassing more traditional asset classes like real estate, S&P 500, the NASDAQ Top 100, and gold.

- The global Bitcoin adoption rate is growing faster than the adoption curve experienced by the internet.

- That in January 2024 the Securities Exchange Commission in the US recognized Bitcoin as the first ever digital commodity which now trades openly in numerous ETFs on the NY stock exchange. This is also the case for the UK, Canada, Australia, Hong Kong, and other leading financial markets.

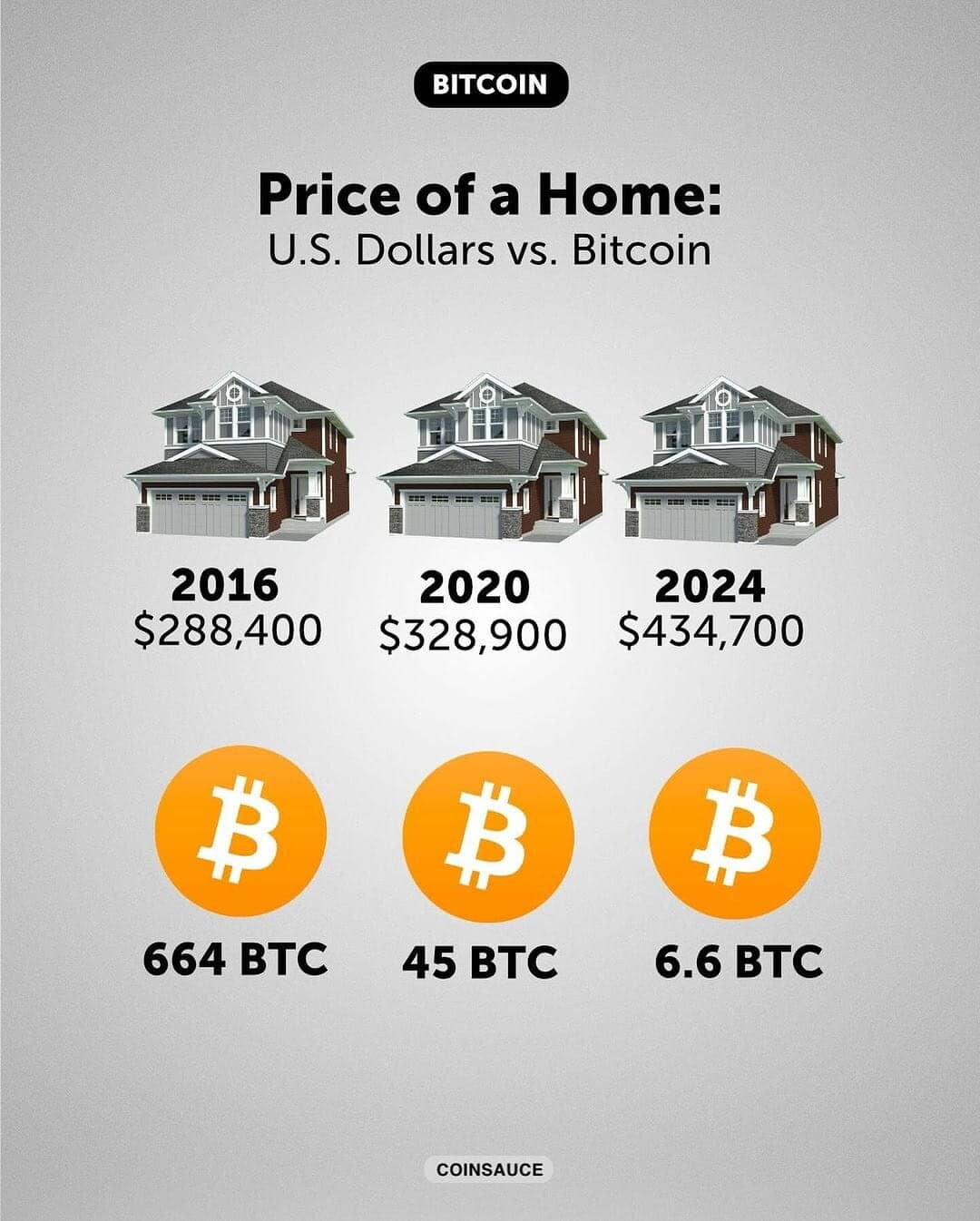

- In 2016 the average cost of a home in North America was USD$288,400 or the equivalent of 664 Bitcoin. That same home in 2024 costs USD$434,700 which is now equal to just 6.6 Bitcoin (as of June 12th, that’s down to 6.3 Bitcoin).

The digitalization of our analogue culture has been led by the most impactful organizations of the past 40 years. Apple digitalized photography, Amazon digitalized retail, and Facebook digitalized our relationships. We’ve lived through the digitalization of music, literature, art, convenience, and most recently how we perform our work. Bitcoin is digitalizing our ability to store wealth and energy without risk of erosion. Said another way, Bitcoin is the digitalization of capital. We work hard for our paychecks, trading our expertise and time for compensation needed to provide for our family’s present and future wellbeing. But the ability to grow or even maintain our purchasing power is under constant pressure through more and more egregious taxes and uncontained monetary inflation.

The opportunity in front of us, no matter your role or industry, is significant. How can we incorporate Bitcoin into our various areas of expertise, our client consultations, deliverables, or how we engage with buyers & sellers? How does HR incorporate Bitcoin in retainment, incentives, and salary match options to attract and keep the best talent? How does Finance allocate a portion of the corporate treasury to Bitcoin and participate in the astronomical upside when held with a 4+ year time horizon? How do you build this asset into your customer loyalty programs, or onboard Bitcoin into your payment’s roadmap? Would steering your Dev career down the Bitcoin path future proof your contributions and focus when built on what’s arguably the most important tech of our lifetimes? What doors would open as you gain area expertise and proactively engage your key stakeholders & customers on a technology with global mass appeal that’s just now starting to break out into the common consciousness.

I work in Market Research and believe the importance of getting a better understanding of Bitcoin is even more crucial for those in my sector. The role of the Market Researcher is to help guide and steer brands and organizations to successful outcomes as these institutions try to navigate disruption and change. If you knew that this technology was performing the most important digital transformation to date, that we’re at the very start of its global S-curve adoption, and that demand for this asset across all industries and sectors was skyrocketing…… would you pay attention now, or look back over the years with a few regrets?

Investing your time in learning about Bitcoin could be the greatest exchange you’ve ever traded. Now in the mainstream, there are numerous introductory books on Bitcoin, and hundreds of thousands of hours you can work through on YouTube and other streaming services. Applying that knowledge to your career will open countless doors as the global adoption rates of the technology continue to set records, and the valuation of the asset continues to surpass new all-time highs.

Now back to time travel.

It’s the year 2044. Bitcoin has continued its ascent transforming capital and cultural markets, climbing methodically up and to the right. It’s held by every sovereign state, pension fund, financial institution, corporation, and consumer globally. It’s still the leading investment asset except now with less volatility due to its impressive scale. Bitcoin rails have been built into every social media community, mobile technology, and payments stack. In fact, entirely new industries and business models have been built on the technological foundation of Bitcoin in ways that aren’t yet obvious. With that likelihood as our backdrop, ask yourself. Knowing what you know now, if you could travel back in time 20 years……would you do anything different?