By: Jackie Lorch

Vice President, Global Knowledge Management

More than ever at Dynata, we are maintaining our focus on unbiased market research – delivering real, reliable opinions from consumers and business.

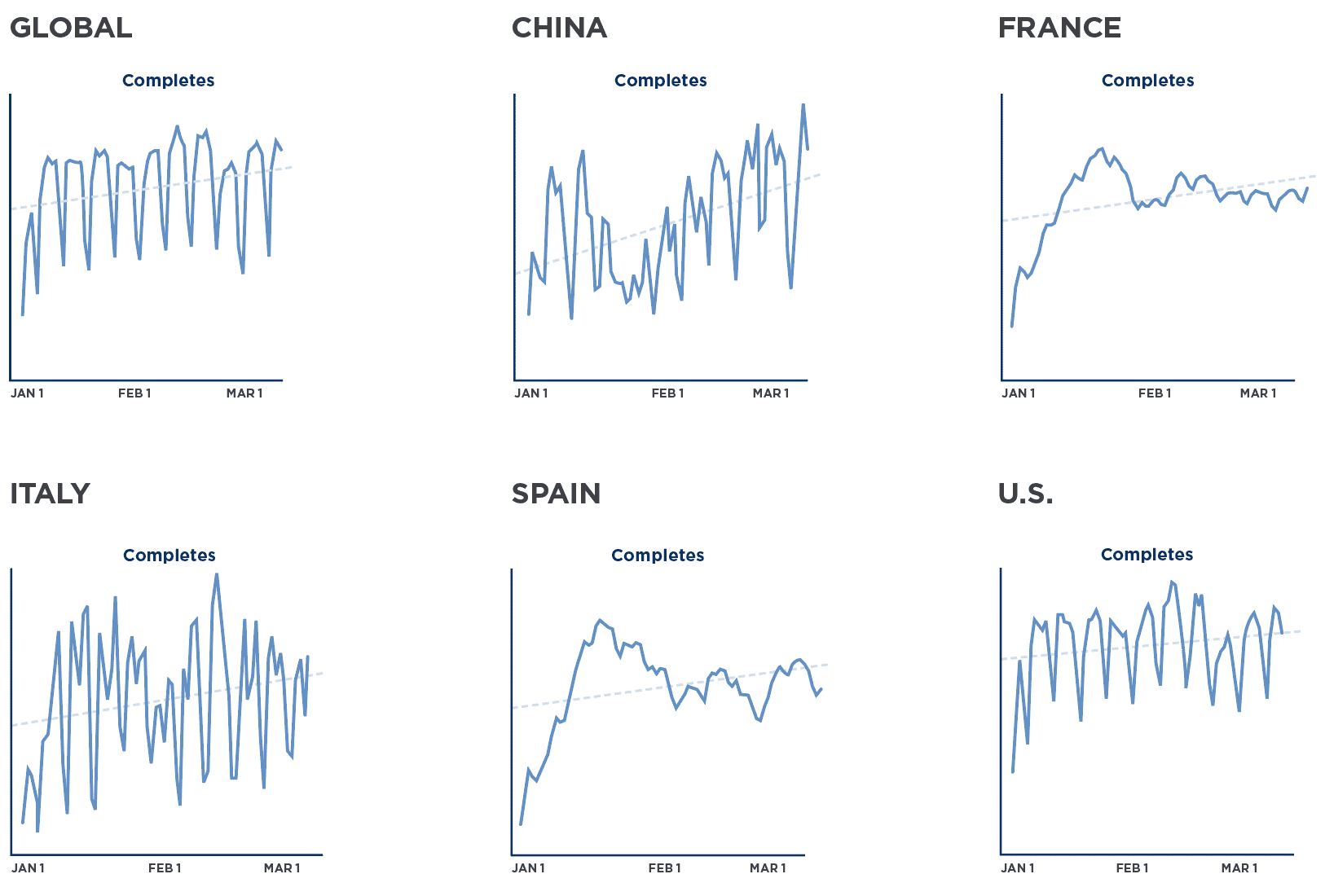

Panelist participation

We do not expect decades of experience of our panelists providing thoughtful, real and accurate data to change – and we have seen no evidence of such a change. We’re closely monitoring our panel metrics (please see Appendix below) and our panelists are participating as usual.

Data differences

Consumers can still provide generalizable data and think objectively about their cars, TVs, household goods and other product and services, but their answers on many topics will be different while the Coronavirus crisis lasts. This reflects the reality of your customers’ experience. It is more vital than ever to keep in touch with them and not risk being left with a data “black hole” as the world recovers.

Opportunities for new insights

While people’s lives are disrupted they may be able to provide different and valuable insights which can be leveraged as the crisis resolves. For example:

- Paper Goods: An emphasis on more frequent cleaning and less choice (due to product scarcity) means people may be using brands they don’t normally use, and, while at home, interacting more often with these items, noting their features and utility more closely.

- Movies and entertainment: With more people staying in their houses, will more at-home

viewing give rise to online group-watches, mimicking the theater-going experience? Could that knowledge lead to new features and technologies? - Home technology: Opinions may be richer as consumers rely heavily on these items to stay connected, becoming more aware of their benefits, features and drawbacks and perhaps start using them in new ways.

Dynata’s multimode capabilities

Dynata supports conducting market research across all modes. For some topics and projects, now might be the right time to consider telephone research, perhaps as a supplement to online, since so many people are available at home. Dynata’s professional interviewers continue to conduct calls from appropriate locations, giving our clients another valuable way to listen to their customers.

Scale and global resources

Dynata’s scale and global coverage allows us to leverage our global teams and resources – including Project Managers, Research Scientists, Data Quality Specialists, Analysts and Infrastructure Support Teams – so projects can be launched, managed and successfully delivered even when there are challenges in certain geographies.

The importance of continuity

It’s vital to keep listening to customers during this period. Continuous data collection will give companies a clearer path forward as the crisis resolves, allowing them to emerge faster with a confident strategy for growth and success as world economies recover.

Best practices

1. Be transparent about how and why you are collecting the data. Keep explanations brief but reassure people who may be concerned about scams or data security.

2. Think about the words you use throughout the questionnaire. Simple strategies like providing thanks and appreciation throughout the survey and offering people the instruction to continue “when you are ready” contribute to positive feelings. Dynata can provide additional suggestions.

3. Discuss appropriate quotas with your Dynata team. Age, geographic or other quotas may need to be adjusted to get the information you need.

4. Use the right quality control questions within the survey to avoid “trapping” participants and losing their valuable input. Dynata has tested all commonly-used controls and can advise on which are most effective and how to use them.

5. Be sensitive to the fact that people may be worried and consider how the wording of your questions might impact them. This especially could apply to healthcare. Consider pausing research with those whose attention is needed elsewhere, such as doctors in infectious disease or pulmonary specialties, to avoid distracting these critical audiences.

6. Consider adding a question about concern or impact from the Coronavirus to use as a segmentation metric. Where appropriate, ask people to think back to an earlier specific period when answering a question.

Appendix — Dynata Interview Completes January – March 2020